Everything In One Place

Your Central Hub

CRM & PIPELINE

Integrate everything into one CRM, including your data, leads, sales, website, team, email, and SMS automation.

CAPTURE

Capture leads using our landing pages, surveys, forms, calendars, inbound phone system & more!

NURTURE

Automatically message leads via voicemail, forced calls, SMS, emails, FB Messenger & more!

CLOSE

Use our built in tools to collect payments, schedule appointments, and track analytics!

About Us

Why Choose MBP

The My Broker Pro Platform is everything that agencies need to manage their client's leads, websites, funnels, calendars and many other services that are needed to maintain a customer.

Our user-friendly AI-powered drag-and-drop feature outshines the complexity of WordPress.

In contrast to ActiveCampaign, MBP provides unlimited contact storage space.

MBP offers a "done for you" setup for your course and coaching business, saving you time compared to setting up Kajabi.

Instead of juggling multiple tools, consolidate your business under one roof with MBP and save $3,000-$5,000 annually on tools.

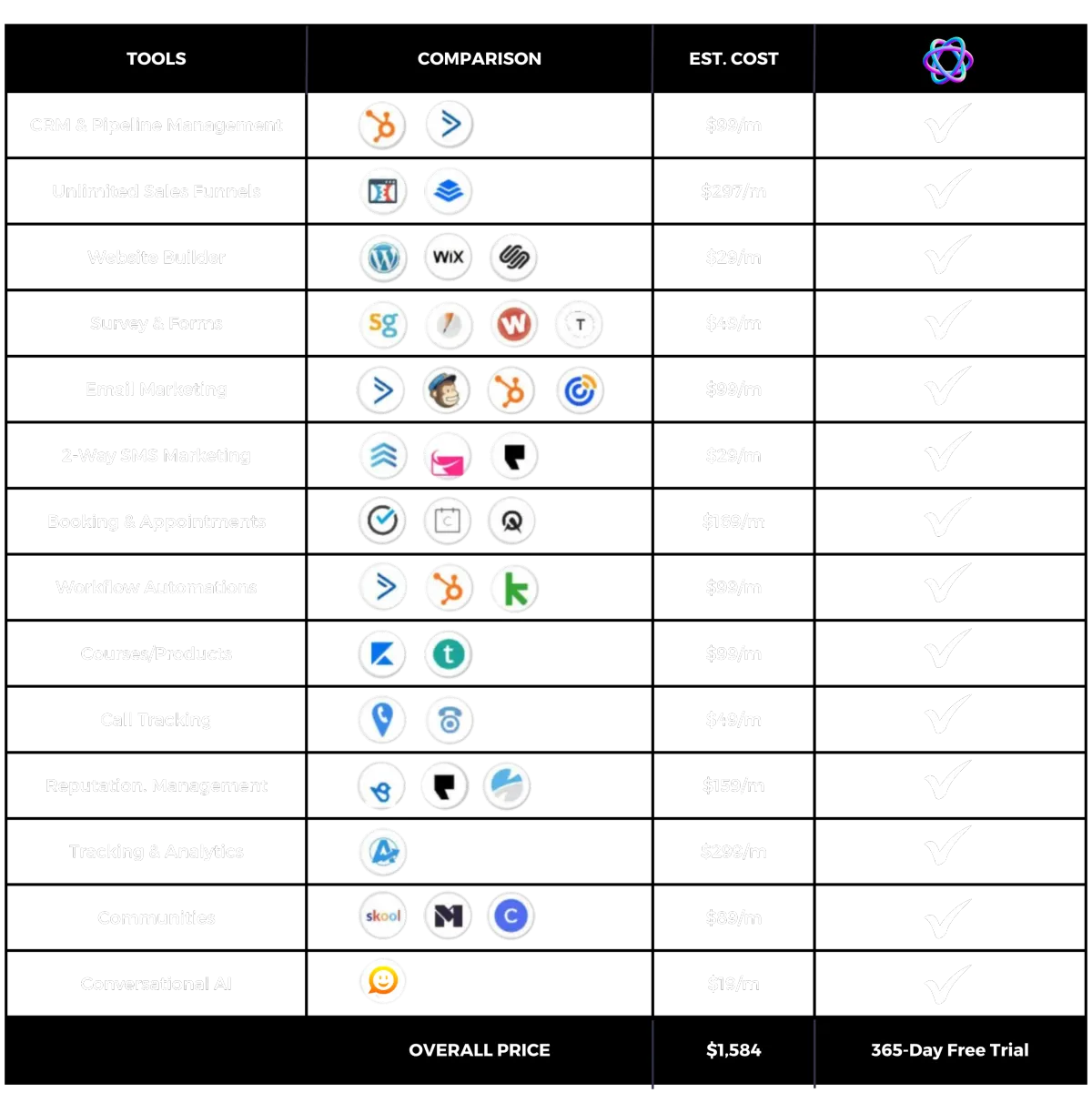

Get All The Tools

Without All The Memberships

Say goodbye to the hassle of merging multiple platforms with "duct tape" and say hello to simple access to all the essential tools on a unified platform with one straightforward membership.

Imagine Combining All Those Services?

Think About The Password Headaches You Will Avoid!

EVERYTHING IN ONE PLACE

MBP offers an all-in-one platform to take your business to the next level!

Website Builder

Create and customize websites. From simple websites to e-commerce stores.

Automated Booking

Managing appointments and AI conversations is a breeze.

CRM & Pipeline

Manage customer relationships, track interactions and nurture leads.

Marketing Automation

Automate tasks, save time and streamline processes.

Wait, There's More!

We've combined all your favourite tools into one platform.

Experience Our Multi-Tool CRM with a 365-Day Free Trial!

It's The Real Deal

Ready to check out MBP for yourself?

Just drop us a line and we'll send you the demo password. Take your time exploring and we're sure you'll see that My Broker Pro is the way to go.

Ask us anything

REQUEST FREE TRIAL

GROW

Your Business

Grow your audience & know where new leads are coming from with Flomatic's easy-to-use CRM. Easily import existing leads to make client communication a cinch!

Communicate Efficiently With Customers and Leads

Reach your customers wherever they are with text messaging. Request reviews, connect with website visitors, collect payments, respond to Facebook & Google Messages, and market to customers and leads all from your app.

Get Paid Faster Than Ever

Collecting payments isn’t anyone’s favorite job. Make paying as quick and convenient as possible for your customers with a secure payment link delivered right to their phone.

5 STAR REVIEWS

What Others Think About Us

It has everything I need and it's allowed me to consolidate my subscriptions. Using this tool has saved me both time and money. I highly recommend you give it a try and get ahead of the competition.

Sarah Mathieu - Mortgage Broker

Stay In The Know

From The Blog

The Best Mortgage Brokerages in Canada: Top & Trending Companies for 2025

What is the Best Mortgage Brokerage in Canada? A List Of Top & Trending Companies

The Canadian mortgage market is diverse and highly competitive, with various brokerages offering an array of services to suit the needs of homebuyers. Whether you're a first-time buyer or looking to refinance, finding the best brokerage can be key to securing the best mortgage rates and terms.

In this article, we rank the top 10 mortgage brokerages in Canada based on size and mortgage volume, highlighting each brokerage’s unique selling points (USPs). We also feature five up-and-coming brokerages making waves in the industry.

Top 10 Mortgage Brokerages in Canada by Volume

1. Dominion Lending Centres (DLC)

Annual Mortgage Volume: $78 billion

Overview: DLC is Canada's largest mortgage brokerage network, with over 3,000 mortgage professionals. Their extensive network and lender relationships give them access to exclusive mortgage products that can’t be found elsewhere. This wide access to products allows for more tailored solutions for clients, from first-time homebuyers to experienced investors.

Unique Selling Points: DLC offers exclusive rates, wide-reaching support for brokers, and a solid training program for newcomers. They are known for their innovation and leadership in the mortgage industry.

Employee Reviews: "Dominion Lending is like a family, supporting brokers with everything they need. The training and technology here are top-notch." — Indeed Review.

2. Mortgage Architects

Annual Mortgage Volume: $15 billion

Overview: As part of the DLC Group, Mortgage Architects is known for its focus on personalized service and innovative mortgage products. They pride themselves on giving their brokers access to proprietary mortgage products and maintaining strong lender relationships.

Unique Selling Points: Mortgage Architects stands out due to its personalized approach and emphasis on broker autonomy. They offer robust training programs and provide brokers with cutting-edge tools to better serve their clients.

Employee Reviews: "They provide fantastic support and allow me to run my business independently while giving me access to products I couldn't get elsewhere." — Indeed Review.

3. Verico Financial Group

Annual Mortgage Volume: $17 billion

Overview: Founded in 2005, Verico Financial Group quickly ascended to one of the top spots in the Canadian mortgage market. Known for its transparency, Verico has a reputation for offering its clients straightforward, competitive rates and exceptional service.

Unique Selling Points: Verico’s core strength is its commitment to providing brokers with a transparent and highly ethical environment, which translates into better client satisfaction. They emphasize providing clear, no-hidden-fee products.

Employee Reviews: "Verico truly values transparency and customer service, which makes it easy to recommend them to my clients." — Indeed Review.

4. Invis & Mortgage Intelligence

Annual Mortgage Volume: $13 billion

Overview: Invis and Mortgage Intelligence work closely together, providing access to over 60 lenders across Canada. These two brokerages are well-regarded for their strong focus on customer service, offering clients a wide array of mortgage products tailored to their needs.

Unique Selling Points: Their ability to offer such a vast range of mortgage products sets them apart from many competitors. Invis & Mortgage Intelligence are also known for their excellent client retention rates due to their personalized approach.

Employee Reviews: "Invis has a great support system for brokers, and the training program helps us stay ahead of industry changes." — Indeed Review.

5. Mortgage Alliance

Annual Mortgage Volume: $12 billion

Overview: Mortgage Alliance operates nationwide, offering a full spectrum of mortgage solutions. Their extensive network of lenders allows them to provide competitive mortgage rates and terms to clients across Canada.

Unique Selling Points: Mortgage Alliance is known for its national presence, combined with localized services. Their ability to offer competitive rates and broker autonomy gives them a strong foothold in the market.

Employee Reviews: "The level of flexibility they provide brokers is amazing, and their network allows us to help clients in every corner of Canada." — Indeed Review.

6. Centum Financial Group

Annual Mortgage Volume: $5 billion

Overview: Centum has a strong presence in Western Canada and is known for its competitive mortgage rates and personalized approach to finding the best mortgage products for clients. With a focus on providing brokers with advanced tools and training, Centum remains a popular choice among brokers and clients alike.

Unique Selling Points: Centum’s unique advantage lies in its focus on education and client engagement. They empower brokers with tools that enhance client experiences.

Employee Reviews: "Centum focuses on making sure the client is at the center of every deal, which is why so many customers are loyal." — Indeed Review.

7. Axiom Mortgage Solutions

Annual Mortgage Volume: Billions (exact figures vary)

Overview: Axiom has made a name for itself by adopting a tech-driven, data-centric approach to mortgage solutions. They offer clients a streamlined mortgage process, making it easier and faster for homebuyers to get approved.

Unique Selling Points: Known for their efficiency and innovation, Axiom is particularly appealing to younger, tech-savvy buyers who prefer a seamless digital experience.

Employee Reviews: "The technology here is second to none. The systems in place make everything so much smoother, which clients appreciate." — Indeed Review.

8. Real Mortgage Associates

Annual Mortgage Volume: $4 billion

Overview: Real Mortgage Associates provides mortgage brokers with the tools they need to succeed, focusing on excellent customer service and competitive mortgage rates.

Unique Selling Points: RMA has built a reputation on flexibility and client-first service. Their brokers are empowered to offer highly competitive products from a broad range of lenders.

Employee Reviews: "RMA always puts the client's needs first, and we have access to more lenders than most other brokerages." — Indeed Review.

9. The Mortgage Centre

Annual Mortgage Volume: $3 billion

Overview: Established in 1989, The Mortgage Centre is one of the oldest brokerages in Canada. They have a long-standing relationship with top lenders, allowing them to offer a wide range of mortgage products to Canadian homebuyers.

Unique Selling Points: Their deep industry experience and trust built over decades make them a go-to for both new and seasoned homebuyers.

Employee Reviews: "With over 30 years of experience, The Mortgage Centre knows how to navigate the market, and it shows in their service." — Indeed Review.

10. True North Mortgage

Annual Mortgage Volume: $3 billion

Overview: True North Mortgage has pioneered a hybrid model that combines online mortgage services with physical locations. Their goal is to provide Canadians with some of the lowest mortgage rates available, both online and in-store.

Unique Selling Points: True North’s low-rate guarantee and no-haggle pricing strategy attract clients looking for simplicity and value.

Employee Reviews: "True North Mortgage’s hybrid approach gives brokers more flexibility and offers clients unbeatable rates." — Indeed Review.

5 Emerging Mortgage Brokerages to Watch

These emerging brokerages are gaining ground by leveraging technology and offering unique client experiences. Keep an eye on them as they continue to grow and innovate.

1. BRX Mortgage

Overview: BRX Mortgage is gaining attention for its tech-forward approach, offering clients a streamlined mortgage process that leverages digital tools for fast, efficient approvals.

Unique Selling Points: BRX focuses on efficiency, using advanced technology to simplify the mortgage process.

Employee Reviews: "BRX is great for tech-savvy brokers who want to offer a faster, more efficient process to their clients." — Indeed Review.

2. Rocket Mortgage (Canada)

Overview: Rocket Mortgage has expanded into Canada, bringing its fully digital mortgage experience to the Canadian market. Clients can apply for and manage their mortgages entirely online.

Unique Selling Points: Fully digital platform, fast approvals, and a user-friendly interface.

Employee Reviews: "The all-digital experience is a game-changer for clients who value convenience and speed." — Indeed Review.

3. Pineapple Mortgage

Overview: Pineapple Mortgage uses advanced data analytics and AI to match clients with mortgage products that best suit their needs.

Unique Selling Points: Data-driven approach to personalizing mortgage solutions.

Employee Reviews: "Pineapple uses data to make the mortgage process more accurate and efficient, and clients love that." — Indeed Review.

4. nesto

Overview: As one of Canada’s leading online mortgage platforms, nesto operates commission-free, allowing them to offer some of the lowest rates on the market.

Unique Selling Points: Commission-free model, offering lower rates to consumers.

Employee Reviews: "The fact that we don’t earn commissions means we can pass those savings to the client, and that’s a huge draw." — Indeed Review.

5. RateShop

Overview: RateShop compares mortgage rates from various lenders, helping clients find the best deals. They combine traditional services with a tech-enabled platform to offer the best of both worlds.

Unique Selling Points: Rate comparison tools and personalized service.

Employee Reviews: "We have access to all the top lenders, which allows us to offer clients great options." — Indeed Review.

By understanding the strengths and unique selling points of Canada’s leading mortgage brokerages, you can make a more informed decision about which one best suits your needs.

Experience Our Multi-Tool CRM with a 365-Day Free Trial!

Try My Broker Pro Today!

We bring all the things you need to solve your digital business problems in one place.

Why MBP?

Integrate everything into one CRM, including your data, leads, sales, website, team, email, and SMS automation.

Solutions

Website & Course Builder

Automated Booking

CRM & Pipeline

Marketing Automation

More Cool Stuff

Web Chat

AI Follow Up

Synchronized Inbox

Reputation Management

Contact Us

c. (778) 655-4321

e. info@mybrokerpro.ca

© My Broker Pro Marketing Agency Ltd. 2024 - All right reserved